Everyone’s eyes are glued to gold and silver right now—and for good reason. These precious metals are sprinting ahead like frontrunners in a marathon. With inflation heating up globally, silver is even outpacing gold, delivering jaw-dropping gains. But here’s the real opportunity: industrial metals like copper and aluminum are surging just as fast. Ignoring them could mean missing out on massive profits. In this article, we’ll break down why prices are skyrocketing and exactly how you can cash in—safely.

Why Are Metal Prices Exploding Right Now?

The rally isn’t random—it’s fueled by massive global demand clashing with limited supply. As technology explodes worldwide, the need for raw materials like silver, copper, and aluminum has gone through the roof.

Consider this: smartphones, laptops, EVs, solar panels—every gadget you own needs these metals. Silver powers solar cells and EV batteries. Copper wires data centers, charges electric cars, and builds renewable energy grids. Aluminum keeps planes lightweight and cars fuel-efficient.

But here’s the supply crunch: mines can’t keep up. Experts estimate that at current copper consumption rates, the world will need 80 new mines by 2030 just to meet demand. Countries like Chile, Peru, and China dominate production, but even they’re struggling.

Add geopolitical chaos—wars in Ukraine, Middle East tensions—and weapons manufacturing is consuming metals at record speeds. The EV boom? It’s devouring copper for motors and batteries, aluminum for lightweight frames. Result: prices through the roof, and no signs of slowing down in 2026.

Gold vs Silver vs Industrial Metals: Who’s Winning?

Gold remains the safe-haven king during uncertainty. But silver? It’s the overachiever—up 25%+ YTD while serving double duty as both jewelry metal and tech essential. Copper and aluminum shine brightest during economic growth phases.

| Metal | 2025 YTD Gain | Main Drivers | Best For |

|---|---|---|---|

| Gold | +18% | Inflation hedge, central bank buying | Conservative investors |

| Silver | +28% | Solar/EVs + safe-haven | Growth + protection |

| Copper | +22% | Green energy, data centers | Industrial boom plays |

| Aluminum | +15% | EVs, aerospace, packaging | Steady compounders |

Data reflects approximate market trends as of late 2025. Past performance doesn’t guarantee future results.

The Real Profit Opportunity: Beyond Gold and Silver

While everyone’s chasing shiny gold bars, smart money is positioning in copper and aluminum. Why? These aren’t just inflation hedges—they’re growth stories. AI data centers need copper wiring. Tesla’s Cybertrucks demand aluminum frames. Every wind turbine and solar farm? More metals required.

Analysts predict copper could hit $12,000/ton by 2027 as supply deficits widen. Silver’s industrial use now accounts for 60% of demand—not just wedding bling. This dual-demand nature means higher highs during both crises AND booms.

5 Smart Ways to Invest in Rising Metals (Ranked by Ease)

Ready to benefit? Here are practical paths, from beginner-friendly to advanced:

1. Physical Metals (Hold It in Your Hand)

- What: Gold/silver coins, bars; copper rounds or ingots.

- Pros: Tangible asset, no counterparty risk, emotional satisfaction.

- Cons: Storage costs, making charges (10-20% on gold jewelry), purity verification.

- Best for: Long-term holders who want “real” metal. Start with 5-10% of portfolio.

2. ETFs & Mutual Funds (Easiest Entry)

- Examples: GLD (gold), SLV (silver), COPX (copper miners), ALMM (aluminum).

- Pros: Buy/sell like stocks via demat account, liquid, no storage hassle.

- Cons: Small expense ratios (0.4-0.8%), tracks spot price imperfectly.

- Best for: Beginners. Allocate $500-2000 to start dollar-cost averaging.

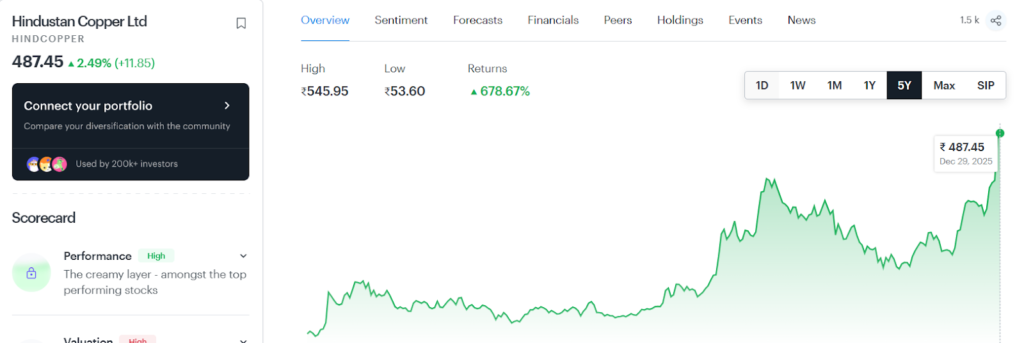

3. Mining & Producer Stocks (Leveraged Upside)

- Targets: Copper giants (Freeport-McMoRan), silver streamers (Wheaton Precious), aluminum leaders (Alcoa).

- Pros: If metal + production volume both rise, returns can double spot gains.

- Cons: Company risks—strikes, debt, management missteps.

- Best for: Moderately aggressive investors. Research top 3-5 names per metal.

4. Commodity Futures (High Risk/Reward)

- Platforms like CME for copper/gold contracts.

- Pros: Leverage amplifies gains.

- Cons: Margin calls, extreme volatility—not for beginners.

- Warning: Only 10% of retail futures traders profit consistently.

5. Themed Funds (Diversified Play)

- ETFs tracking clean energy (ICLN), EVs (DRIV), or critical minerals.

- Perfect for broad exposure without picking individual metals.

Essential Risks You Must Understand

No sugarcoating: metals swing wildly. A Fed rate cut sends prices soaring. China slowdown? Instant correction. Dollar strength crushes commodity prices.

Key Watchlist:

- Geopolitical headlines (wars, sanctions)

- US/China economic data

- Fed interest rate path

- Inventory reports (LME/COMEX stocks)

Portfolio Rule: Never exceed 10-15% allocation to metals/commodities. Diversify across asset classes.

Step-by-Step Action Plan: Start Today

- Define Goal: Inflation protection (gold/silver ETFs) or growth bet (copper stocks)?

- Set Budget: Start small—$1000 split across 2-3 options.

- Choose Platform: Zerodha/Groww for ETFs, demat broker for stocks.

- Dollar-Cost Average: Invest fixed amount monthly, ignore short-term dips.

- Track Weekly: Follow Kitco.com, Bloomberg Commodities app.

- Rebalance Yearly: Take profits when allocation hits 20%.

Who Should Jump In—and Who Should Wait?

Perfect Fit:

- Inflation worriers building emergency funds

- Young investors seeking portfolio diversification

- EV/tech believers betting on green transition

Skip If:

- Need money in <12 months (volatility kills)

- Risk-averse (stick to FDs/bonds)

- Chasing “10x in 1 month” dreams

Final Word: Position Now, Profit Later

Gold and silver grabbed headlines, but copper and aluminum offer the biggest 2026 upside. With supply shortages looming and green tech exploding, this rally has legs. Start small, stay disciplined, and let compounding work.

Disclaimer: This is educational content only—not investment advice. Consult a SEBI-registered advisor. Past performance ≠ future results. Invest at your own risk.

Turn on notifications—next: “Your 90-Day Metals Investing Blueprint” drops soon.